The planned transition to a sustainable economy within the European Union could have positive long-term economic effects, according to a global credit agency.

S&P Global Ratings made the findings after a recent investigation on the impact of reducing emissions and the growth of Gross Domestic Product (GDP).

In its analysis, the agency recognises the EU still has a long way to go before it can reach its goal of becoming the first emissions-neutral continent but also rejects the widespread belief that emission reduction would have a long-term negative impact on economic growth.

The few existing studies on the correlation between emission and GDP growth estimate that a climate rise of 3ºC – with reference to the pre-industrial era – would be an “ideal” in economic terms.

However, scientists believe that global warming of more than 1.5ºC would already have very negative consequences for life on the planet.

In its report, S&P Global Ratings says these previous models are:

- Underestimating the negative impacts climate change would have at that scale, because they only take into account the rise in temperature. This, therefore, leaves out the impact of rain and droughts, biodiversity, or the point of of no return that would incur an escalation of costs to control climate change.

- Overstating the cost of reducing emissions, since renewable energy is getting cheaper – sometimes cheaper now than fossil fuels.

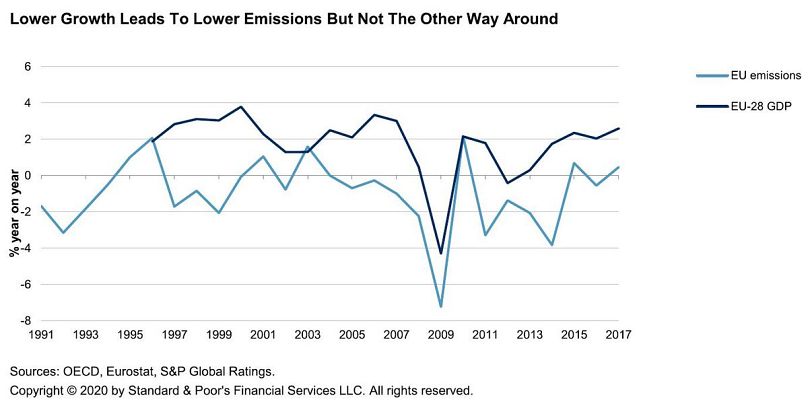

In short, the report explains that although lower economic growth does lead to a reduction in emissions, emission reductions do not necessarily lead to a fall in GDP.

It said: “Our research corroborates the EU’s view that the move to more sustainable economic growth should boost growth. We test the causality between emissions from EU countries and GDP and shows that while lower GDP can cause less emissions, lower emissions do not cause less growth. “

What the report does not specify is how large-scale climate change will impact the European Union – whatever its efforts – if major pollutant nations such as China, India and the United States do not make drastic efforts themselves.

The following graph shows in the last ten years – after the recovery of the crisis in 2009 – the emission reductions (in 2011, 2014 or 2016) do not correspond to equivalent reductions in GDP growth.

Much to do

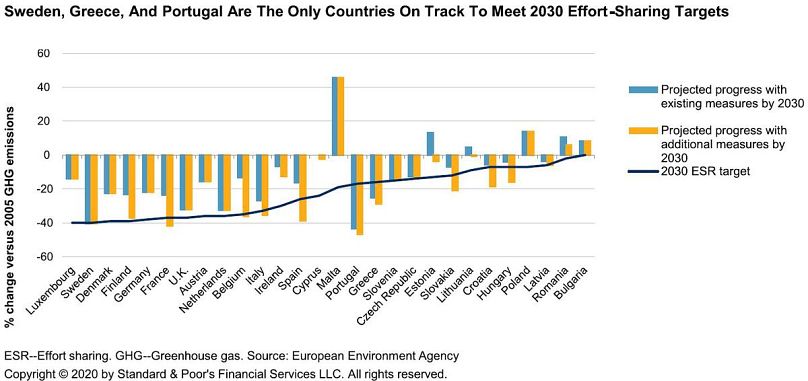

At the moment, almost no European country is approaching the emission targets set in the EU’s Green Pact for 2030.

The worst countries, so far, on working toward this goal are Malta, Luxembourg, Cyprus, Estonia, Ireland and Poland.

Meanwhile, Spain, Finland, Belgium, France or Italy are recovering lost time with additional measures (yellow on the graph) but at the current rate (blue) they would be far from reaching the objectives of the so-called “Effort Sharing” (ESR) , represented by the black line.

One of the problems, according to the S&P study, is that policymakers are still too shy when it comes to imposing higher prices on carbon emissions – which, they say, is the most effective method to reduce emissions.

Nor are sufficient efforts being made to allocate 1.5% of annual GDP to reducing emissions and improving energy efficiency, it said.

The polluter pays, but not enough

The agency also warns the EU will not be able to achieve its objectives set for 2050 alone, and that it will have to tighten the legislation since much of the effort depends on national governments and the private sector.

It ends by saying that although the bloc could reach net zero emissions by 2050, it must also take care of the carbon that it currently imports.

This would involve applying taxes to imports from its main trading partners and major national polluters.

According to S&P: “This would lead to an increase in prices and therefore harm the purchasing power of consumers. It could also increase tensions and uncertainty in world trade, which leads to less investment.”